Market Risk Exposure Insight: Portfolio Stress Testing

Modgile Consulting offers the ability to optimize bespoke alternative asset portfolios by stress testing portfolios to understand market risk exposure during key market downturns to expose strengths and possible weaknesses to construct bespoke alternative asset portfolios tailored to an investor’s risk appetite.

Expectation During Market Downturns

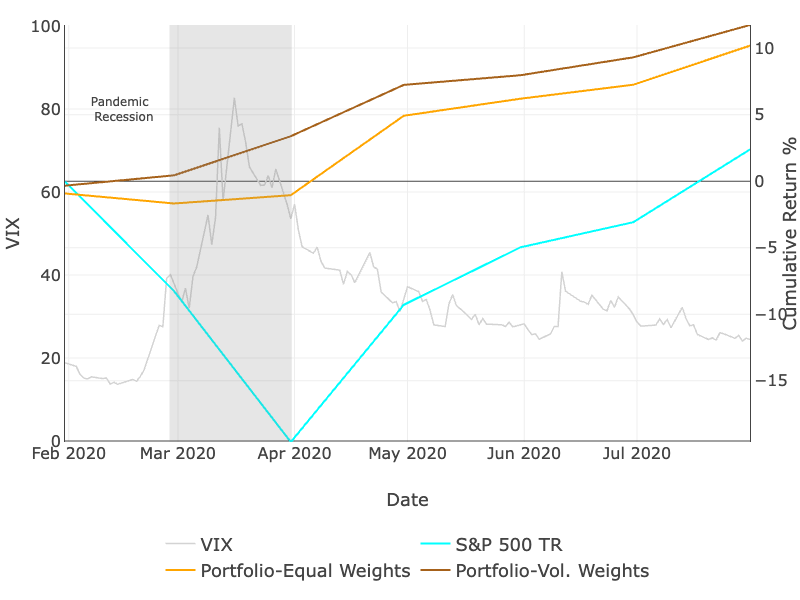

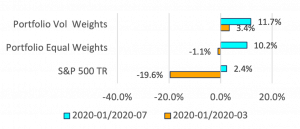

Stress testing performance during drawdowns and 2020 recession

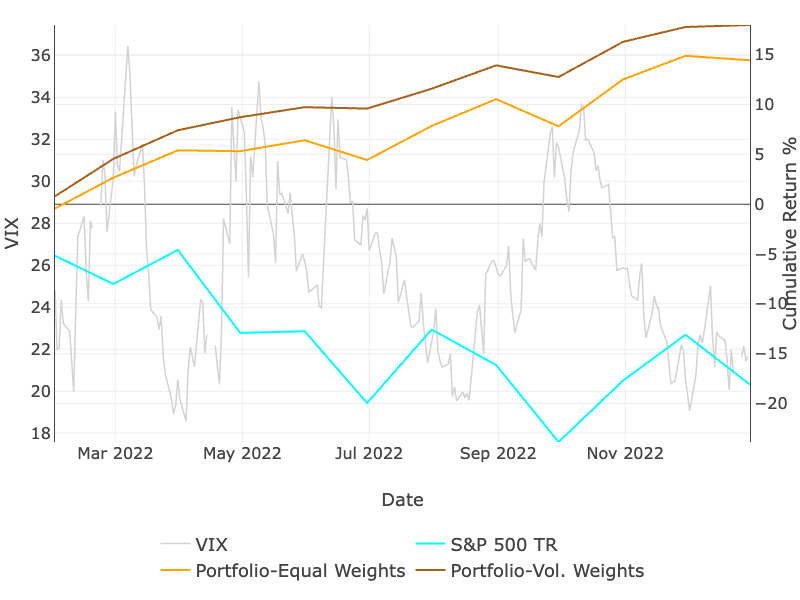

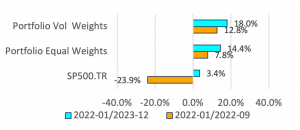

Stress Period: FED Rate 2022 Increase

Stress Period: Pandemic Recession 2020

Stress Period: FED Rate Raise 2022

Disclaimer: Investments In Alternative Assets Have Elements Of Risk Different From Or Greater Than Those Associated With Other Investments, Including Illiquidity, Lack Of Transparency, And Significant Volatility. The Higher Degree Of Risk Makes Investments In Alternative Assets Suitable Only For Investors Who (A) Have A Continuing Level Of Annual Income And A Substantial Net Worth, (B) Can Afford To Bear Those Risks And (C) Have No Need For Liquidity From Those Investments. The Results Of Investments In Alternative Assets May Vary Widely Based On The Classes Of Assets Chosen, The Risks Posed By Each, Cross- Collateralization Of All Investments Made, And Factors Beyond Forecast Or Control, Including Changing Market Conditions, Adverse Political Developments, And Force Majeure. Modgile Consulting Consults On Investment Risk Management. No Investment Is Without Risk.