Gaining insight into leverage, counterparty risk, liquidity risk, capital preservation and stop loss levels, exposure, market risk provides a framework to identify where downside risk may emerge.

Not All Alternative Asset Strategies Are Created Equal

Risk management framework

Leverage

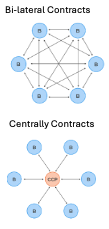

Counterparty Risk

Liquidity Risk

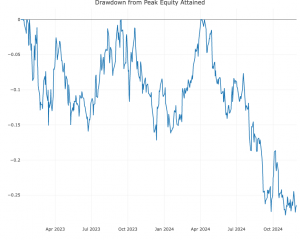

Preserving Capital Gains

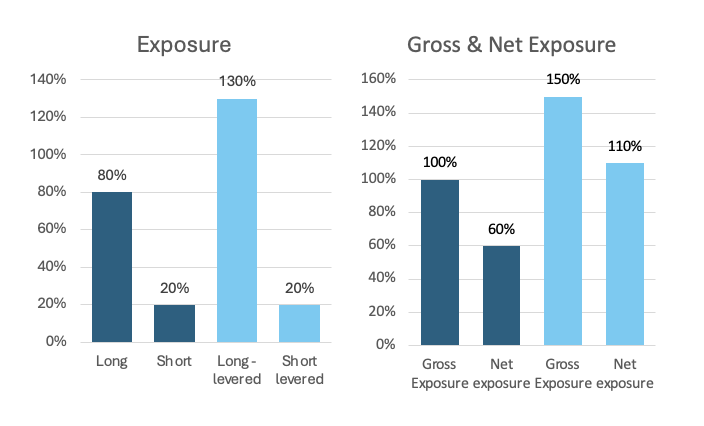

Exposure: Gross vs Net

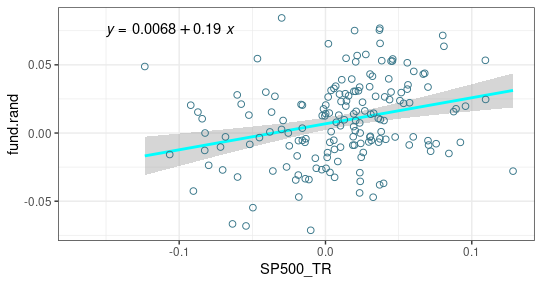

Market Risk

Disclaimer: Investments In Alternative Assets Have Elements Of Risk Different From Or Greater Than Those Associated With Other Investments, Including Illiquidity, Lack Of Transparency, And Significant Volatility. The Higher Degree Of Risk Makes Investments In Alternative Assets Suitable Only For Investors Who (A) Have A Continuing Level Of Annual Income And A Substantial Net Worth, (B) Can Afford To Bear Those Risks And (C) Have No Need For Liquidity From Those Investments. The Results Of Investments In Alternative Assets May Vary Widely Based On The Classes Of Assets Chosen, The Risks Posed By Each, Cross- Collateralization Of All Investments Made, And Factors Beyond Forecast Or Control, Including Changing Market Conditions, Adverse Political Developments, And Force Majeure. Modgile Consulting Consults On Investment Risk Management. No Investment Is Without Risk.

- Leverage: The use of leverage will magnify returns, but it will equally magnify losses as well. One key point to understand what collateral the underlying alternative asset fund has available to avoid having to liquidate the position at an in-opportune time for the underlying fund’s investment strategy.

- Counterparty risk: Evaluating counterparty risk, such as whether trades are OTC or exchange trades, assist with understanding the risks with being able to exit positions

- Liquidity risk: Liquidity risk in this context is the liquidity of the investments of the underlying alternative asset, not the terms of the underlying alternative asset fund; although they are likely related. Understanding how an underlying asset fund is able to exit a profitable position and to cut losses is important to gain insight into an underlying fund’s investment strategy.

- Capital Preservation and Stop Loss Levels: Stop loss levels have a trade off of managing downside risk with the possible trade off of future upside returns. The risk appetite for downside risk is one of the key questions to understand.

- Gross / Net exposure: Gross / net exposure provides insight into the short vs long book of the underlying alternative asset fund’s portfolio as well as any leverage that is used.

- Market risk: Market risk exposure identifies how much an underlying alternative asset’s returns will be impacted by the underlying market returns.

Modgile Consulting has experience assessing risks of emerging alternative asset managers by speaking with investor relations, portfolio managers, and traders of prospective alternative asset fund managers.