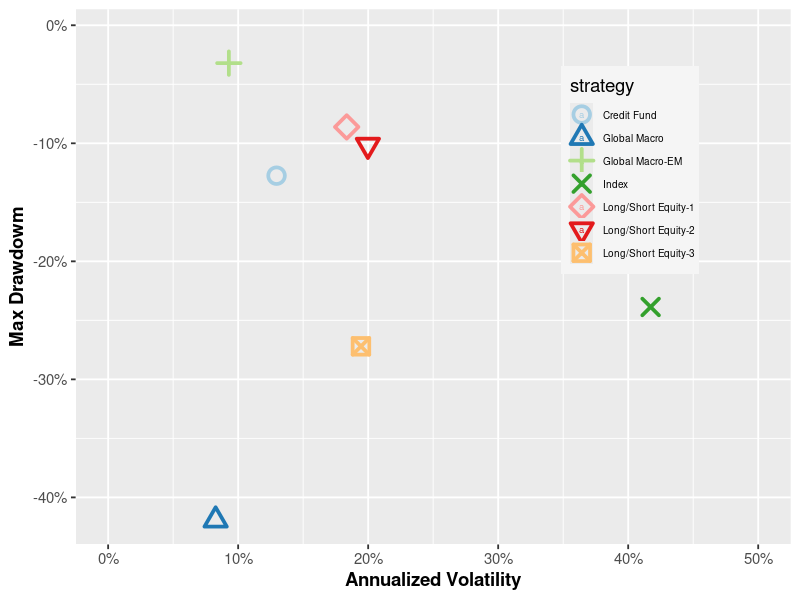

Absolute returns that are not correlated to the broader equities market tends to be the goal of alternative assets. The crux of the challenge is identifying alternative assets strategies that can achieve high absolute returns without downside volatility and low market risk. Focusing on uncorrelated assets is the starting point.

In Search of High Absolute Returns

Maximum drawdown, cumulative returns, and asset correlations provide insight

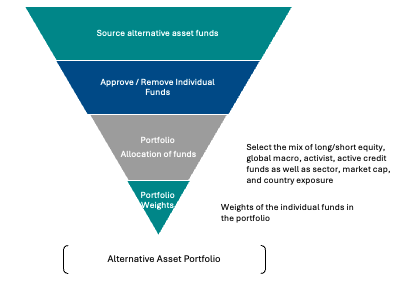

Distilling the Core Alternative Asset Strategy

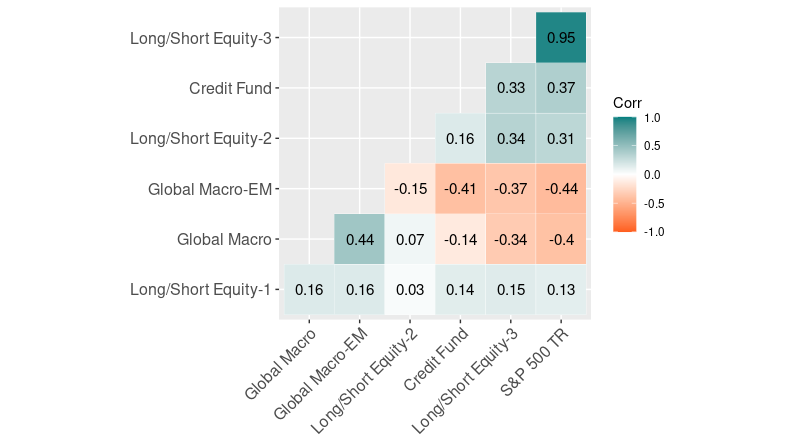

The Benefits of Negative Correaltion

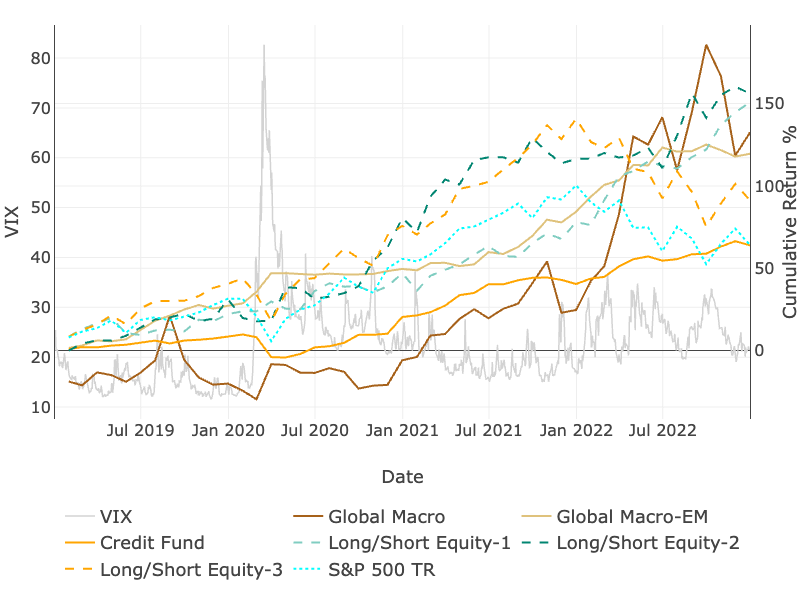

Cumulative Returns

The Alternative Asset Correlation Matrix & Correlation to the US Equities Market

Max Drawdown & Volatility

Disclaimer: Investments In Alternative Assets Have Elements Of Risk Different From Or Greater Than Those Associated With Other Investments, Including Illiquidity, Lack Of Transparency, And Significant Volatility. The Higher Degree Of Risk Makes Investments In Alternative Assets Suitable Only For Investors Who (A) Have A Continuing Level Of Annual Income And A Substantial Net Worth, (B) Can Afford To Bear Those Risks And (C) Have No Need For Liquidity From Those Investments. The Results Of Investments In Alternative Assets May Vary Widely Based On The Classes Of Assets Chosen, The Risks Posed By Each, Cross- Collateralization Of All Investments Made, And Factors Beyond Forecast Or Control, Including Changing Market Conditions, Adverse Political Developments, And Force Majeure. Modgile Consulting Consults On Investment Risk Management. No Investment Is Without Risk.